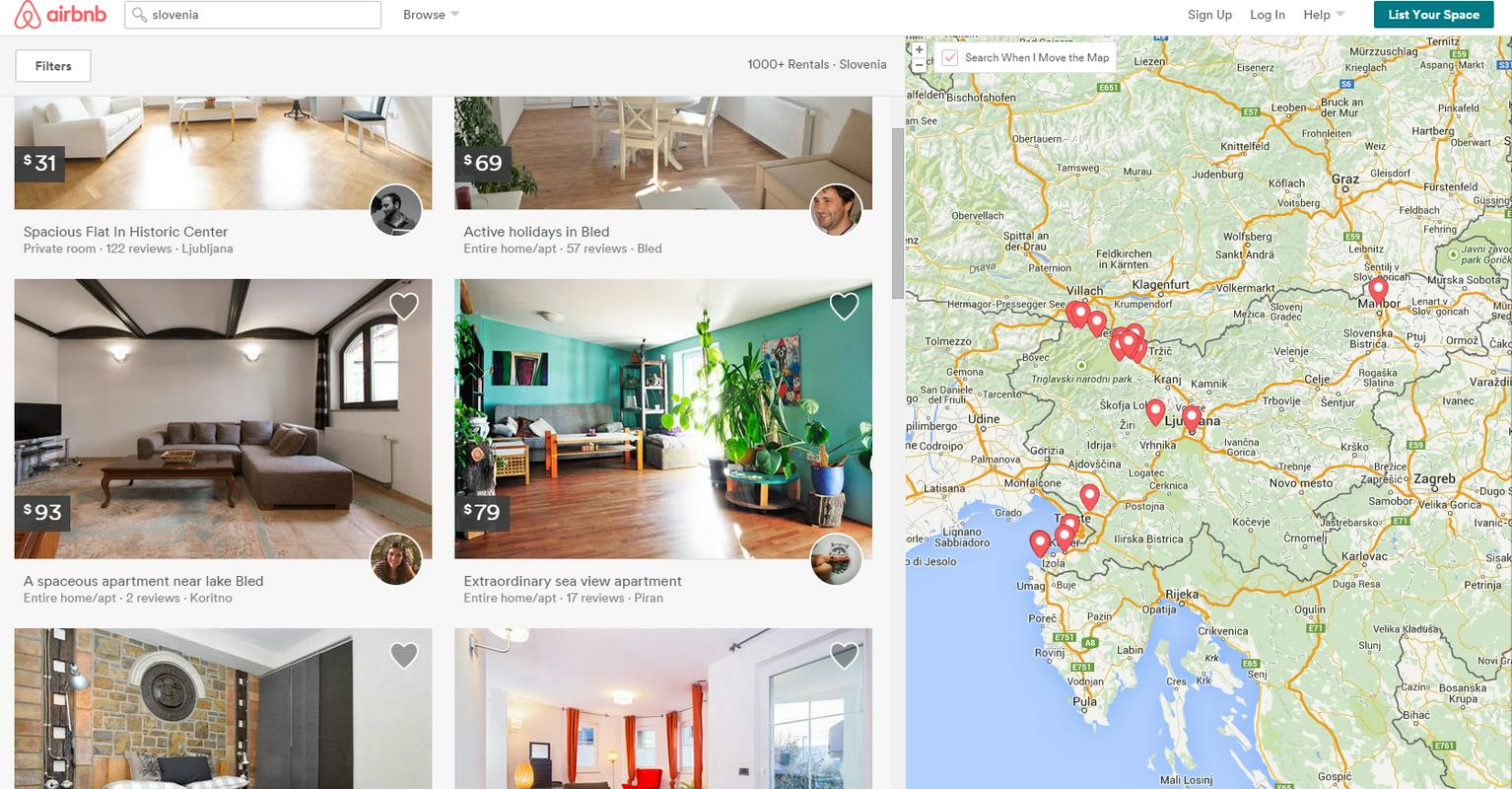

What is Airbnb?

AirBnB web platform developed from the idea of occasional renting out of an empty room to travellers, which helps pay the rent for the apartment. It is a connecting link between couchsurfing, meaning free-of-charge overnight accommodation of travellers who spend the night on a couch or in easy chairs, the main purpose of such travellers is getting to know new people and gaining new friends and socialize, and payable rooms in hostels, hotels, and apartments.

Airbnb first came to life at the West coast of the USA, where a number of other web giants emerged. With the help of numerous investors, one of them being Ashton Kutcher who gave a financial contribution, and helped with establishing trade mark, it developed into an important world player offering overnight accommodations all over the world. It incurred the wrath of the hotel industry which consider such an offer of overnight accommodations as unfair competition. After all, last April the weekly Economist magazine predicted that Airbnb, providing its development continues with the same speed, would already in 2016 eat away a 10% share from the hotel industry.

Renting of apartments, as envisioned by Airbnb, does not satisfy neither the Tax office nor the local communities, as their budgets depend also on tourist taxes, which most often are not charged to guests by those renting apartments. Airbnb claims that their purpose is to provide contacts between people looking for overnight accommodations and those offering them, and that charging of requisite taxes in individual cities and states is the responsibility of local authorities.

A number of cities throughout the world consider this activity as grey economy, and they have started charging rather high penalties to those renting their homes. Barcelona punished Airbnb as well for violation of local tourism laws with the penalty in the amount of 30,000 euros. Therefore the decision was made that Airbnb would start charging the required taxes, which consequently resulted in higher prices and less of a competitive edge compared to other providers of tourist accommodations.

Numerous obstacles in Slovenia

A number of Slovenian laws regulating tourist accommodations or renting of real estate are adverse to the Airbnb idea of offering accommodations to travellers. Occasional renting of apartments may also be considered illegal work, to which »war« was declared last year by the Financial Administration (Furs).

"Any natural person renting his/her own apartment must declare the income, which is then taxed as income from self-employment (within the undertaking) or income from renting property (forecast of the personal income tax from renting property must be handed in not later than January 15 for the past year)," remind representatives of Furs, and emphasize that the activity of accommodating guests performed by a natural person renting rooms is considered as an income from self-employment, and as such must be entered into the business register.

According to Slovenian legislation, natural persons can rent rooms also when this activity is performed only occasionally, but not for a longer period than five months per year, and they can rent to guests up to 15 beds. This applies to providers of accommodations during touristic season. In case the providers of occasional accommodations are not registered for this activity, their income is subject to tax as income from renting property, just as lessors of apartments and other real estate.

Appeal for removal of obstacles

Registration of activity or taxable rents are not the only problems the Slovenian providers through Airbnb are facing. The initiators of the proposal for modernisation of regulations which would facilitate short-time renting of real estate warn that when renting of a real estate lasts longer than five months per year it needs to be categorized, an approval of co-residents obtained if the apartment is located in an apartment block, an operating permit for the apartment must be obtained, guests must be registered with the Police … They suggest a simpler registration of apartments, electronic registration of guests, and electronic payment of tourist taxes, plus suspension of the time limit of five months a year.

The first response of the Ministries (of Economy, of Finance, of Interior, and of Public Administration) to their initiative is encouraging. They are all in favour of the solutions which would facilitate this activity through Airbnb. Only the Ministry of the Environment and Spatial Planning consider that "due to the specific legal nature of the floor ownership the activity of renting rooms in an apartment building can't be performed without the consensus of floor owners". "We are aware that the legislation should adapt to new activities and the development, and are willing to help find a solution. Perhaps in future a smaller percentage required for consent should be considered when introducing changes in housing legislation," was the comment from the Ministry of the Environment and Spatial Planing.

It will be interesting to see the solutions passed by the government, and how fast it will happen. Airbnb is not the only web service offering a simple way for earning some extra money, but the rigid and obsolete legislation is standing in their way.

Gregor Cerar

Translated by G. K.