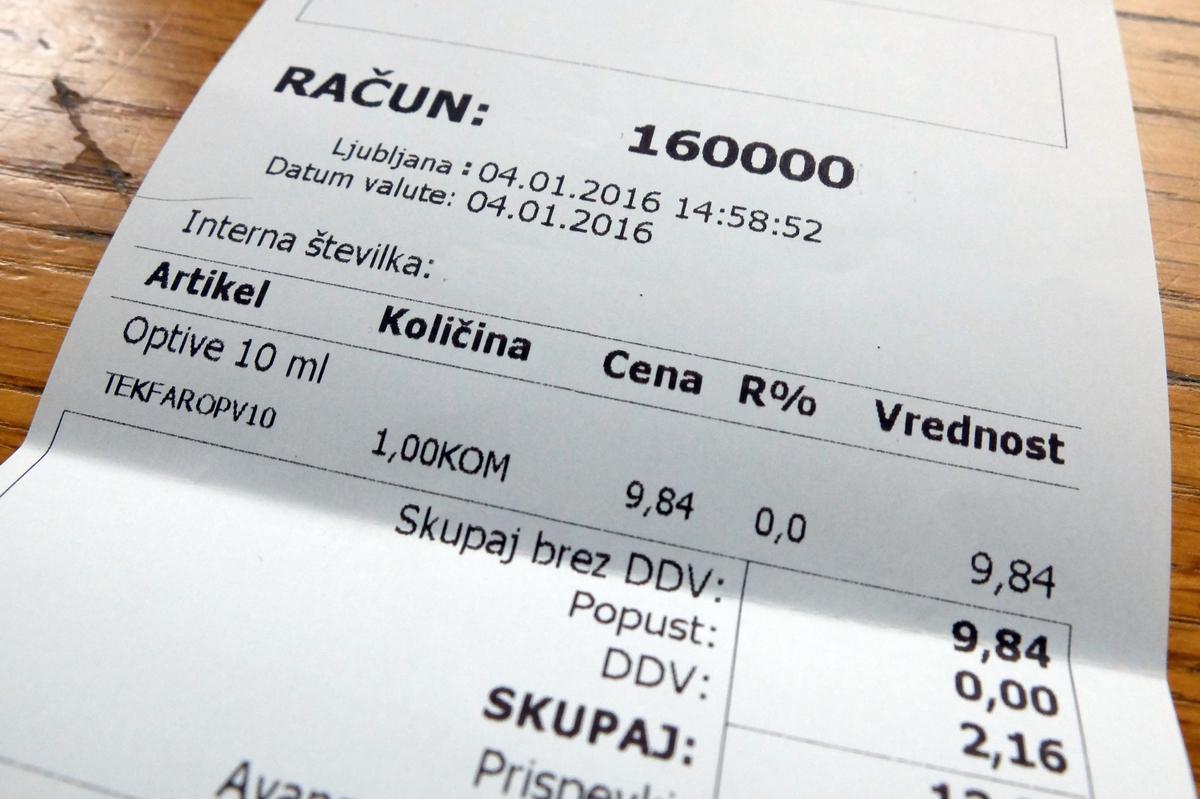

The most frequent violations found by financial controllers were failure to issue receipts, and cash operation without a tax register. According to data from the Financial Administration, some 41,000 taxable persons have tax registers, while 11,000 more are using the free internet service »miniblagajna«.

The administration estimates that taxable persons have adjusted well to the new system, while the Chamber of Craft and Commerce warns of the unexpected problems brought by the new tax system.

According to Peter Jenko, Director of Supervision Administration, that indicates that the taxable persons have adjusted well to the new system. "I can say that the situation in the field regarding the use of certified tax registers is good, as prove the already performed inspections, and checking of receipts with the help of the application Preveri račun," Jenko said.

The prize contest with the help of which consumers checked five million receipts in two months however brought some unexpected problems for some taxable persons, said Branko Meh, President of the Chamber of Craft and Small Business of Slovenia. "Some guests started notifying that they had not received the receipt, which directly leads to inspection, which than proves that the receipt had been issued. It might be also the move made by competitors, in order to push somebody from the market," Meh said.

Jure Čepin, Radio Slovenija

Translated by G. K.